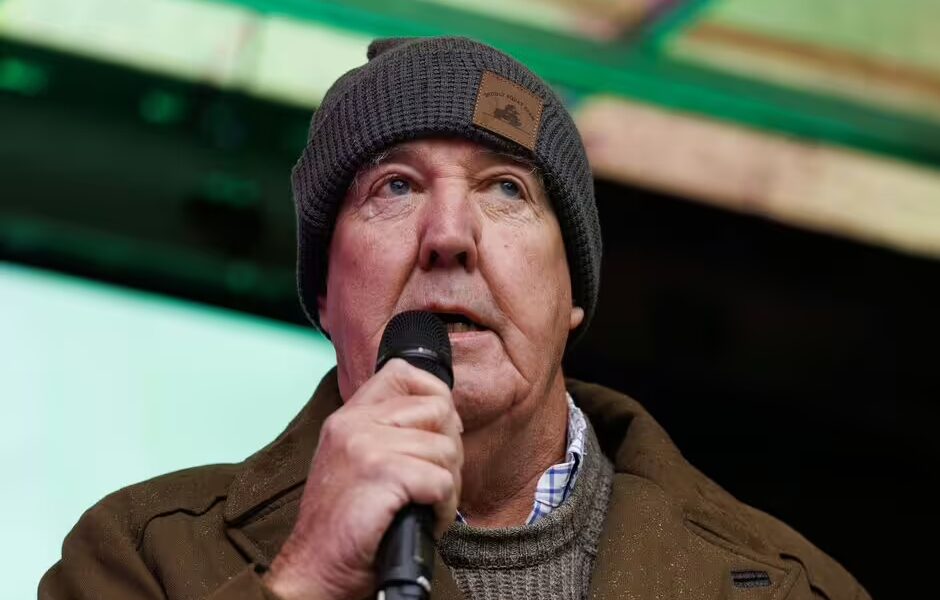

Jeremy Clarkson has become the latest pub landlord to ban all of the 404 Labour MPs from his pub.

Jeremy Clarkson has become the latest pub landlord to take a stand against the Government’s Budget and rising business rates by refusing entry to every Labour MP at his Cotswold pub. His move comes as a nationwide campaign, ‘No Labour MPs’ has gained momentum, with more than 250 pubs, restaurants and hotels reportedly signing up to bar all of the 404 Labour MPs in protest at rising taxes.

The action was sparked by Dorset publicans and has since spread nationwide, with landlords describing it as a last resort. The movement began in Bournemouth, where James Fowler, the owner of the Larder House pub, stated that pubs were being pushed beyond their limits. Now, the Clarkson’s Farm star, 65, has also extended a ban at The Farmer’s Dog, his £1 million pub near Burford in Asthall Barrow, to cover the entire Labour parliamentary party.

The Farmer’s Dog has a restaurant, farm shop, butchers and outdoor bar (Image: Getty)

Clarkson had already barred Prime Minister Sir Keir Starmer when the pub opened last year, but he said the latest tax changes have left him with no choice but to widen the ban.

He said his pub’s annual business rates have soared from around £28,000 to more than £50,000, calling it a ‘disgrace’.

Clarkson, 65, told The Sun: “I was well ahead of the curve when I banned Starmer. Every Labour MP is barred now.

“Our annual business rates have gone up astronomically from something like £28,000 to well over £50,000. It is a disgrace.”

Chancellor Rachel Reeves claimed in her Budget that she was delivering permanently lower tax rates for more than 750,000 retail, leisure and hospitality properties, the lowest since 1991.

UK Hospitality, however, has estimated that smaller venues such as pubs, bars and cafés will face an extra £318 million in business rates over the next three years, despite Government claims of lower headline rates.

Allen Simpson, Chief Executive of UKHospitality, said in a letter to MPs: “Many Members of Parliament have raised concerns that they believed from the Budget speech that business rates bills for hospitality businesses in England were falling to support the high street, and that the move would be paid for by higher taxes on the online giants.

“I am clear that MPs’ concerns are correct – far from a tax cut on hospitality, this is an unprecedented tax rise which disproportionately harms hospitality and protects the online giants and supermarkets.

“Without intervention, we face business closures, reduced investment and a contraction in youth employment. This outcome is totally contrary to the Government’s manifesto commitment to ‘level the playing field between the high street and online giants.”

Keir Starmer’s official spokesperson said the Chancellor had delivered a £4.3bn support package for pubs, restaurants, and cafes because hospitality is a “vital part of our economy”.

He said: “Without this intervention, pubs would have faced a 45% rise in bills next year. We’ve cut that down to just 4%.

“We’ve also maintained the draught beer duty cut, eased licences rules over pavement drinks and events, and capped corporation tax.

“These measures show we’re backing hospitality not abandoning it.”